Corporate Governance

- Governance Highlights

- Basic Policy

- Corporate Governance Structure

-

Management Introduction

/ Skills Matrix

-

Succession Plan

(Selection and Development Policy for Executive Management) -

Evaluation of the Effectiveness of the Board of Directors

-

Officer Remuneration

-

Risk Management

-

Basic Policy on Internal

Control Systems

Click here to download Corporate Governance Report

Governance Highlights

Meetings held in FY2024.

Basic Policy

The nucleus of the KOSÉ Group’s management policy is “consistently managing to heighten corporate value” by pursuing growth and greater efficiency. The Group recognizes corporate governance functions as essential from the standpoint of managing the Company to consistently increase its enterprise value, and positions corporate governance as one of its highest management priorities. Accordingly, the Group is working on establishing the necessary organizational systems and frameworks to ensure sound management and consistently earn the trust of society.

KOSÉ believes strongly in managing the Group so as to maintain harmonious relations with all stakeholders, including shareholders, investors, creditors, customers, business partners, employees and communities. Furthermore, KOSÉ is committed to enhancing transparency and fairness to earn support as a company with value. The Company strives to communicate sincerely with its stakeholders and considers building trust-based relationships to be fundamental.

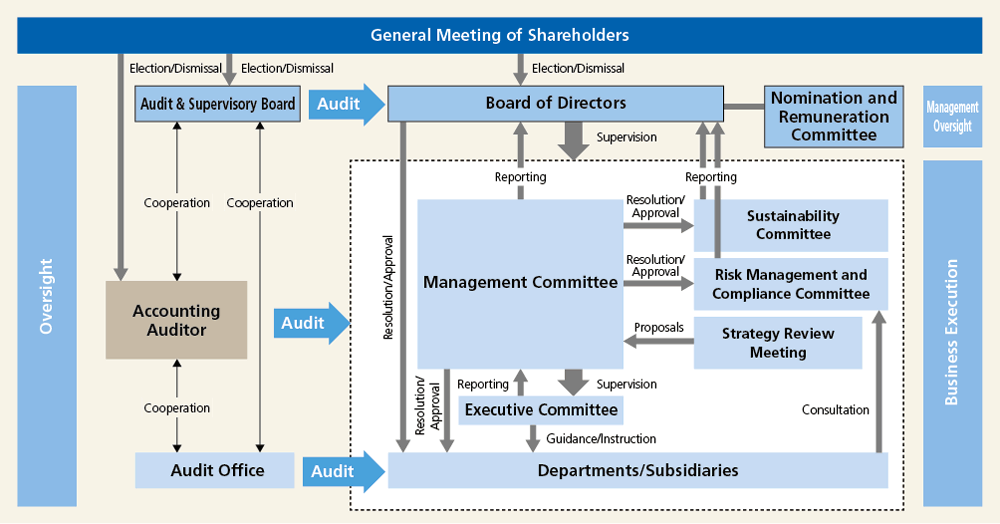

Corporate Governance Structure

KOSÉ has adopted a Company with an Audit & Supervisory Board corporate governance structure and performs audits to confirm that directors are performing their duties properly.

For the swift and efficient execution of business, the Company employs the Board of Directors, the Management Committee chaired by the President & CEO, the Strategy Review Meeting, the Executive Committee, and other bodies as necessary. The Company has also voluntarily established the Nomination and Remuneration Committee, a majority of which is composed of independent officers, and which is chaired by an independent external director, to deliberate on the appropriateness of officer remuneration and officer appointments. The Company has determined that it is appropriate to have independent external directors and Audit & Supervisory Board members to provide audit and supervisory functions in addition to a system of checks and balances by officers familiar with the business

Board of Directors

KOSÉ strives to ensure that the Board of Directors has an optimal balance of knowledge, experience, and skills, as well as a size that is appropriate for the Company. The Board is also expected to reflect diversity, with the Company making no distinctions based on characteristics such as nationality or gender in the selection of members.The Company has appointed external directors with a high level of expertise and extensive insight to provide advice on business execution, as well as to monitor and supervise each director. The scope of authority of directors in the execution of business is clearly defined, enabling swift decision-making by a small number of directors. The Company has introduced an executive officer system, under which executive officers appointed by the Board of Directors execute business appropriately for their assigned departments in accordance with the basic management policy determined by the Board of Directors. The Company’s Board of Directors meets once each month, in principle, to decide on matters provided in laws and regulations and the Articles of Incorporation and important management-related matters, as well as to supervise the execution of duties by directors.Directors are formally elected individually within the same resolution at the General Meeting of Shareholders.

Audit & Supervisory Board

For the Audit & Supervisory Board, the Company has appointed an attorney at law and a certified public accountant with high-level expert knowledge and abundant insight to monitor and supervise the execution of business by directors. Audit & Supervisory Board members attend important meetings such as Board of Directors meetings and Management Committee meetings, communicate with Audit & Supervisory Board members of domestic Group companies as appropriate, exchange information and opinions with internal audit departments and the accounting auditor, and conduct internal audits of departments within the Company and of its subsidiaries regularly as required.

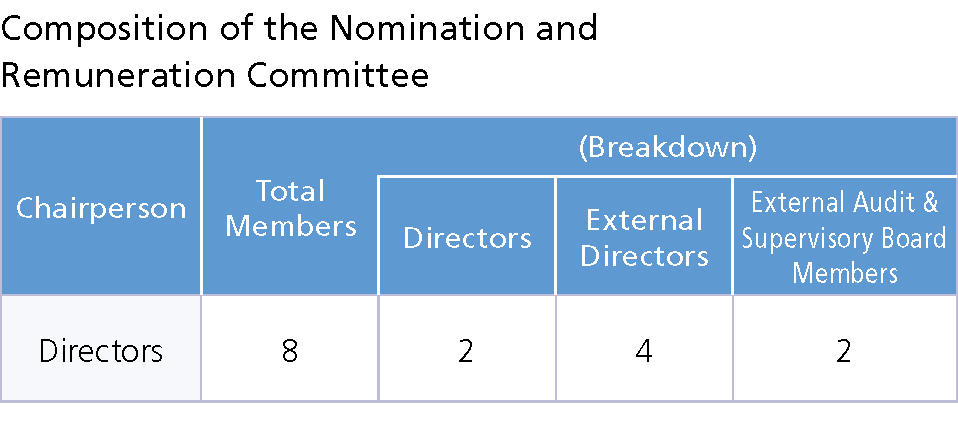

Nomination and Remuneration Committee

The Nomination and Remuneration Committee examines proposals concerning nominations, remuneration and other matters that are submitted by the President & CEO to the Board of Directors. This committee exists for the purpose of reinforcing the independence, objectivity and accountability of activities by the Board of Directors concerning nominations, remuneration and other matters involving the directors, Audit & Supervisory Board members and executive officers. The committee is chaired by an external director to ensure objectivity.

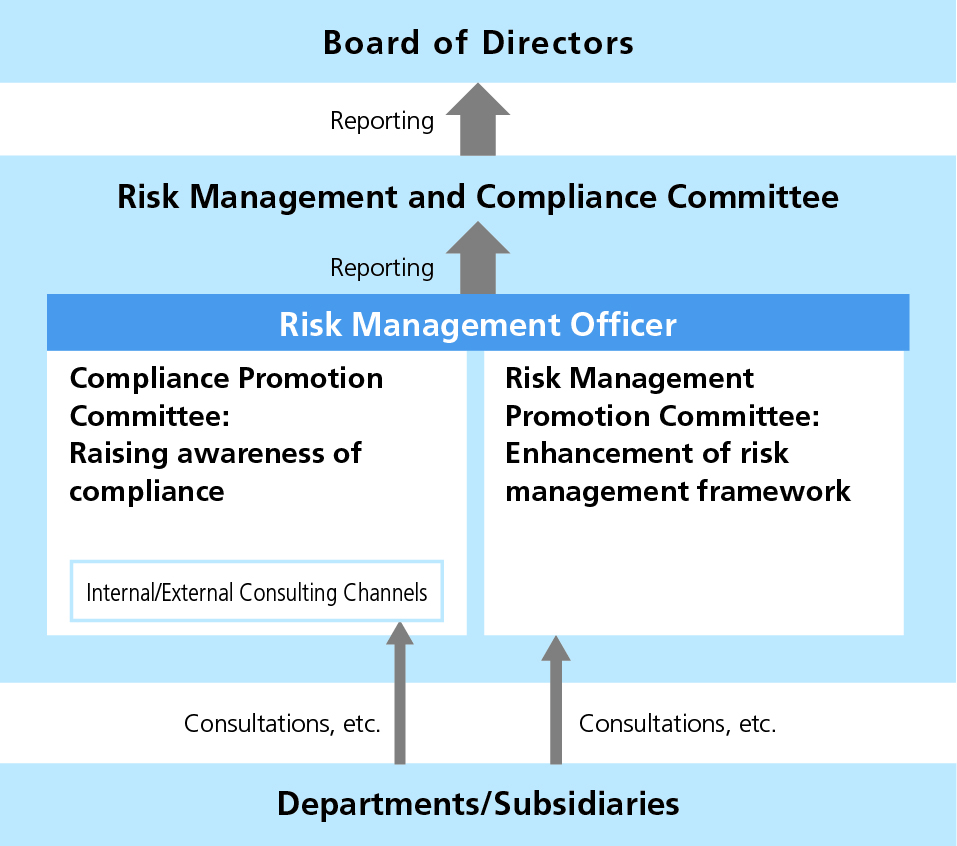

Risk Management and Compliance Committee

For the Company, compliance encompasses compliance with laws and regulations as well as behavior consistent with social ethics based on “Mind to Follow the Right Path.” This scope of compliance includes adherence to ethical behavior as stipulated in the KOSÉ Group Action Guidelines. Oversight is provided to the Board of Directors through regular reporting and deliberation on the risk management and compliance structure and activities. These are facilitated by the Risk Management and Compliance Committee, which is chaired by the President & CEO and primarily composed of department heads. Risks are reviewed at least once a year.

In addition, the Compliance Promotion Committee conducts awareness-raising activities, such as training for directors and employees. Compliance is monitored through a system for managing reports and consultations, with both internal and external consultation channels available. In addition, to respond to risk factors that pose a threat to the sustainable development of the Company, particularly various risks such as problems involving compliance, quality, information security and markets as well as natural disasters, the Company has established Risk Management and Compliance Regulations and is working to enhance its risk management structure by establishing a Risk Management Promotion Committee. The chairperson of the Risk Management Promotion Committee (the General Manager of the General Administration Department) designates departments as 'risk owners' based on the significance of the risks. Departments designated as risk owners formulate countermeasures, monitor their implementation, and report regularly to the Risk Management Promotion Committee. The Risk Management Promotion Committee is primarily composed of the heads of relevant departments within the Company.

The Company has also created a framework based on its Crisis Management Regulations for minimizing damage in the event a major risk materializes.

The Sustainability Committee

The KOSÉ Group views issues related to sustainability as management issues and has established a system for promoting solutions to these issues. Specifically, the Sustainability Committee, chaired by the President & CEO, has been established to propose sustainability strategies to the Management Committee for approval and reporting to the Board of Directors. The Board of Directors is responsible for overseeing the company's overall sustainability promotion activities by reporting and deliberating on various important issues related to sustainability strategies. The President, who chairs the committee, is also responsible for assessing and monitoring risks and opportunities related to climate change issues. These issues are reported and discussed at the Board of Directors meeting at least twice a year, and efforts are reviewed. In addition, based on the KOSÉ Group’s Sustainability Strategy, the Sustainability Promotion Committee has established subcommittees and projects for each individual theme to promote activities that are highly effective as cross-departmental initiatives.

Management Introduction / Skills Matrix

Skills Matrix

Succession Plan (Selection and Development Policy for Executive Management)

-

Policy on the appointment/dismissal of Executive Management, and the Nomination of Candidates for Directors and Audit & Supervisory Board Members

The Company considers the development of future executive leadership to be one of its key priorities in achieving sustainable growth and strengthening competitiveness. In order to drive global business growth, leaders must understand diverse and rapidly changing markets and possess the ability to solve problems unconstrained by convention. Executive management, who are responsible for critical decision-making, must be capable of responding flexibly to changes in the business environment and making sound judgments. To ensure the strategic and continuous development of successors, we have clarified the qualifications required for executive roles, selected candidates from a long-term perspective, and are promoting a structured and deliberate approach to leadership development.

-

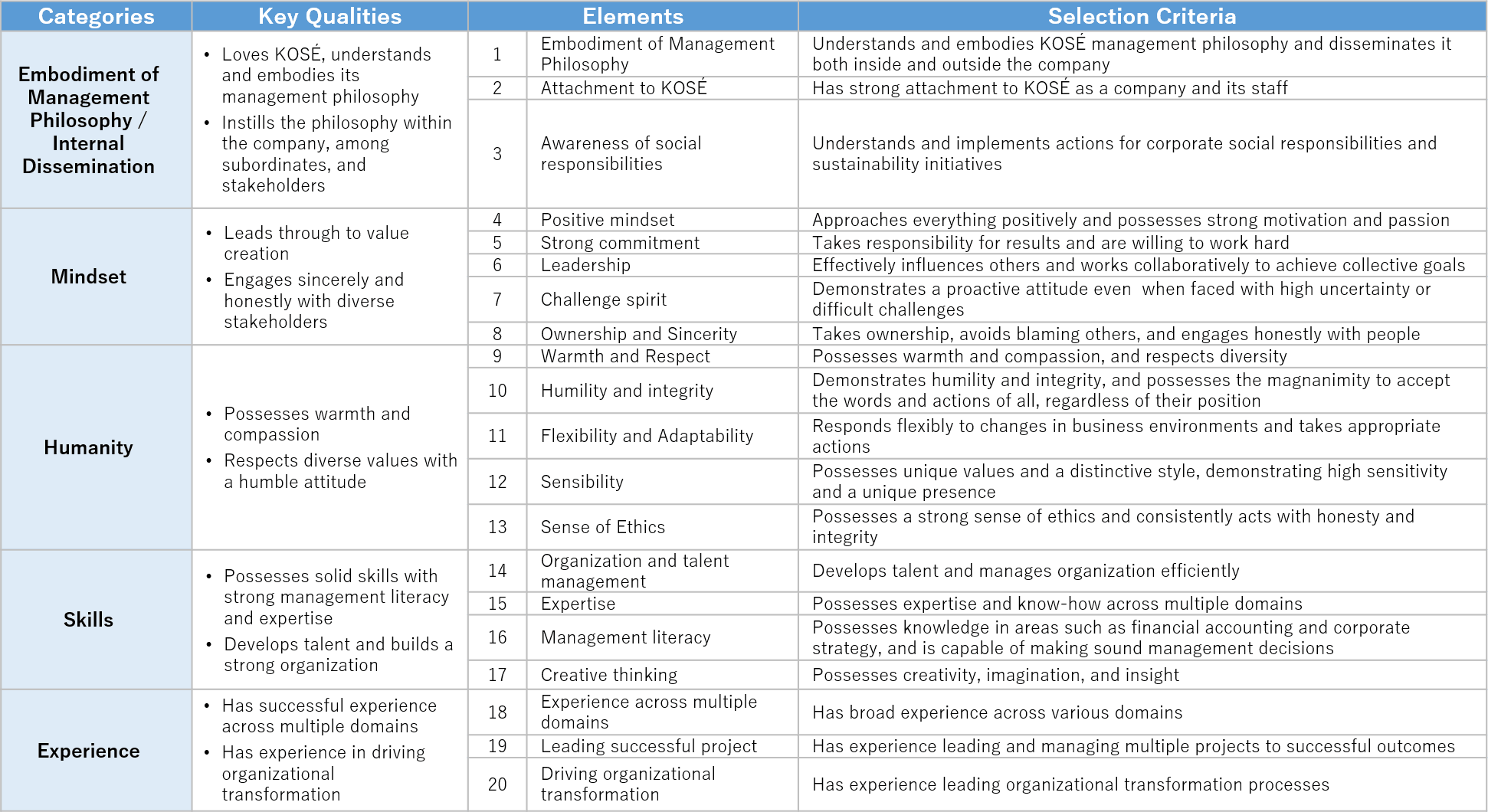

Required Qualifications

When appointing and dismissing Executive Management and nominating candidates for Directors and Audit & Supervisory Board Members, we comprehensively assess qualities such as their ability to instill the corporate philosophy across generations, strong cohesive power, execution capabilities, character, career background, and competency. We have defined five key categories of qualities and competencies required of executive leaders. Through a wide range of professional experiences, individuals are expected to develop these attributes and become capable of navigating an evolving business environment.

![]()

-

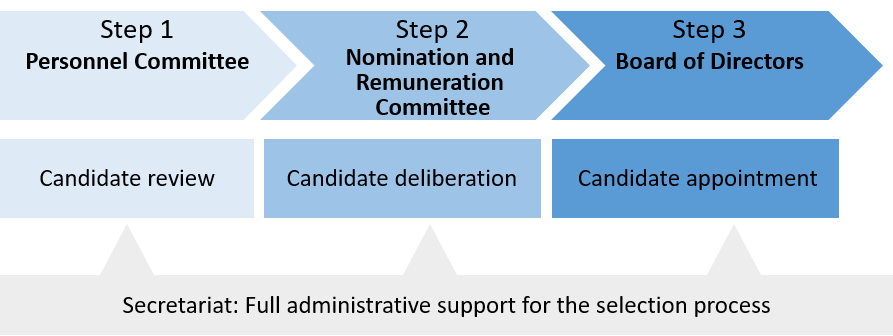

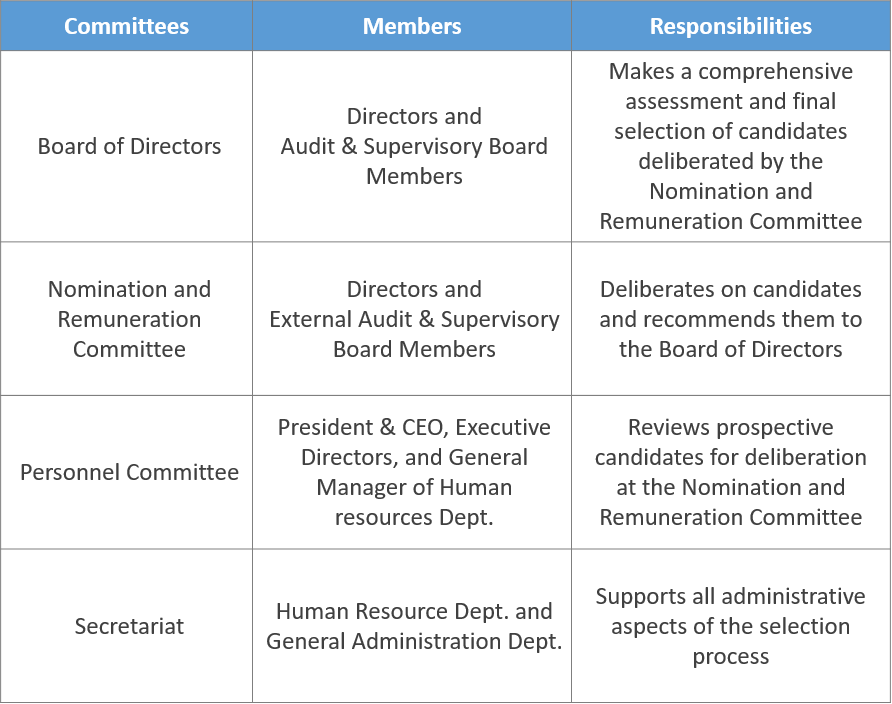

Selecting process

As for the procedures in appointments and dismissals of Executive Management and nominations of candidates for directors and Audit & Supervisory Board members, Executive Management drafts proposals in the Personnel Committee and submits them to the Nomination and Remuneration Committee, which is chaired by an independent external director and whose majority of members are independent external directors and Audit & Supervisory Board Members. Following the deliberation, the proposals are submitted to the Board of Directors for a comprehensive assessment and final decision. The reasons for each appointment or dismissal of Director and Audit & Supervisory Board Member candidates are detailed in the reference materials of the Notice for the General Meeting of Shareholders.

![]()

![]()

-

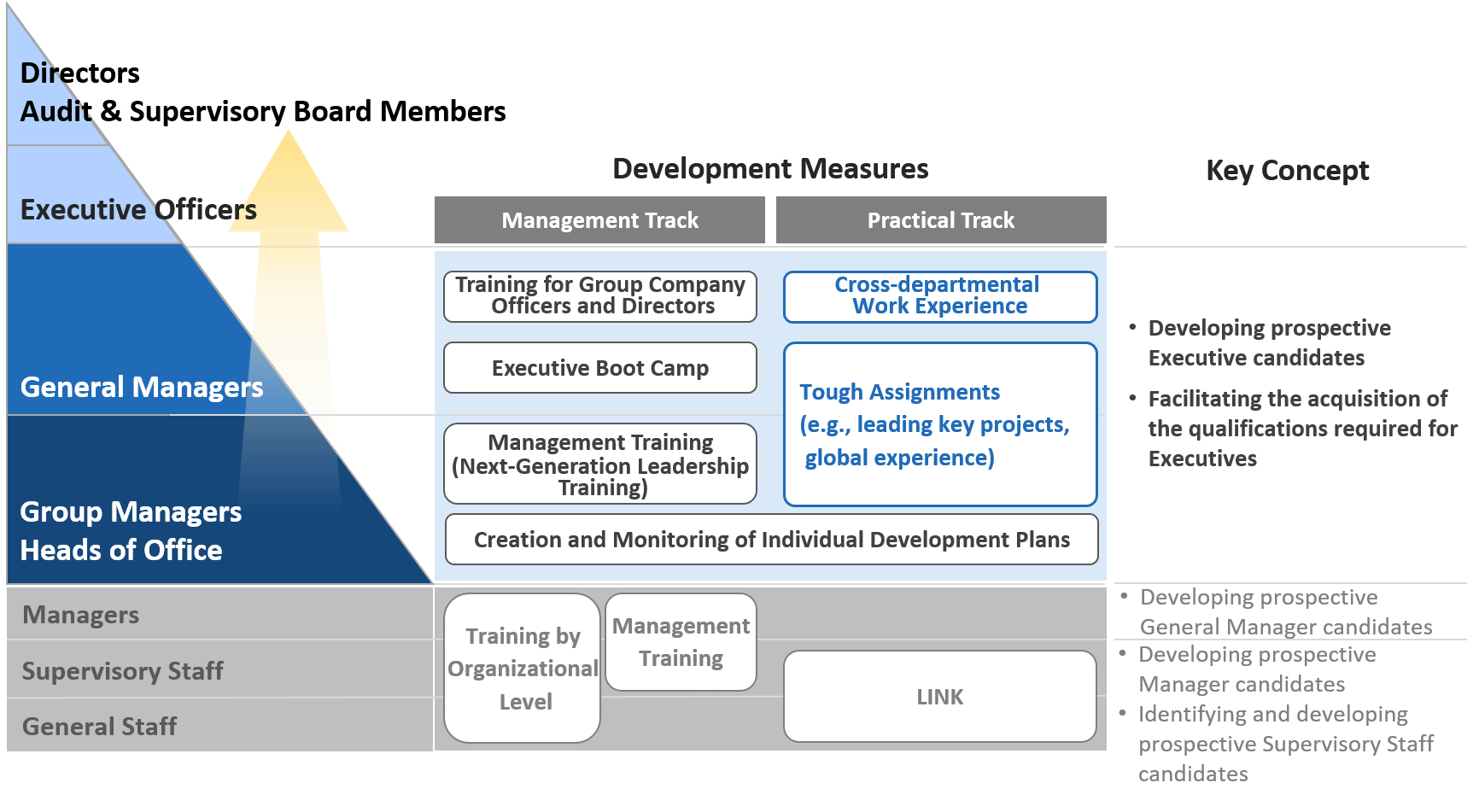

Development and Support

Assuming the core quality of embodying the company‘s management philosophy has already been acquired, we develop prospective General Manager-level candidates, who are future executive leaders, through both managerial and practical approaches to cultivate their mindset, humanity, skills, and experience.

Going forward, we will also focus on expanding the pool of future executive candidates by fostering mid-level managers at the Manager level and below. This includes implementing leadership training and job rotation to help them acquire the core qualities required for Executive Management.![]()

Evaluation of the Effectiveness of the Board of Directors

To further strengthen corporate governance, the Company conducts an evaluation of the effectiveness of the Board of Directors at least once a year. The method for this evaluation is as follows.

-

Evaluation Method

Directors and Audit & Supervisory Board members were asked to complete questionnaires regarding the following items. A third-party organization was used to determine items included in the questionnaires. It also collected and analyzed the results of the questionnaires. Based on the results, the Board of Directors performs an analysis and evaluation of the Board’s effectiveness and considers actions that should be taken.

-

Main Evaluation Item

- Composition and operation of the Board

- Management and business strategies

- Corporate ethics and risk management

- Performance monitoring

- Evaluation and remuneration of management

- Dialogue with shareholders

Officer Remuneration

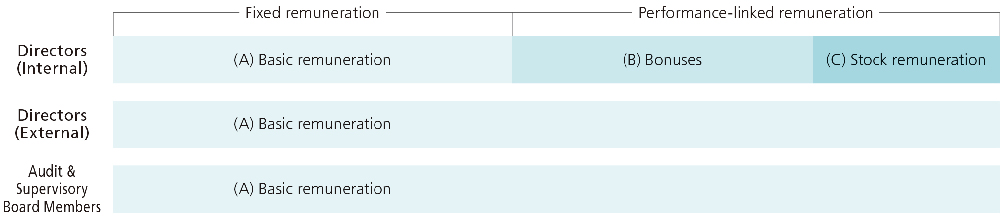

Overview of Officer Remuneration

For remuneration of Company officers, the Company has decided on a remuneration framework that emphasizes increasing corporate value over the medium to long term.

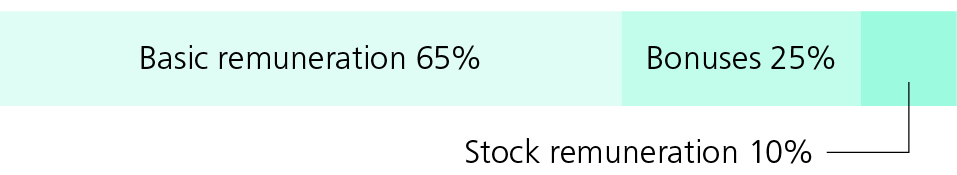

Composition of Remuneration

Composition of Remuneration for the President & CEO

Method for Determining Officer Remuneration

Officer remuneration shall be classified into (1) directors and (2)Audit & Supervisory Board members for voting at the General Meeting of Shareholders and allocated to each officer within the total amount allowed for each officer classification. The Nomination and Remuneration Committee, which is composed mainly of external officers, discusses the appropriateness and validity of remuneration, and the Board of Directors has resolved to re-entrust the final decision on remuneration to the President & CEO, premised on the results of this discussion. Remuneration of Audit & Supervisory Board members is determined by mutual agreement among the Audit & Supervisory Board members.

-

Basic Policy for Officer Remuneration

For the remuneration of the Company’s directors and Audit & Supervisory Board members (officer remuneration), the basic policy is designed and implemented based on the following goals in order to achieve medium-to-long-term growth of corporate value.

- A remuneration framework that enables the KOSÉ Group to achieve global and borderless growth

- An appropriately competitive level of remuneration for attracting and retaining highly talented individuals

- A highly independent, objective and transparent remuneration framework that fulfills the responsibility of accountability to business partners,

-

Remuneration Levels

A suitable level of remuneration is determined by taking into account KOSÉ’s business environment as well as a survey and analysis using external databases and other sources to ascertain remuneration at companies in the same industry and of the same size.

-

Process for Determining Remuneration

To ensure the objectivity and transparency of the officer remuneration system, the appropriateness and validity of the allocation to each director are first discussed by the Nomination and Remuneration Committee, which is composed mainly of external officers. Using the results of these discussions as the premise for determining remuneration, the final decisions about individual remuneration are entrusted to the President & CEO by the Board of Directors. The President & CEO has the authority to determine the basic remuneration for each director and the bonuses and stock remuneration based on results of operations of the business overseen by that director. The President & CEO is given this authority because, as the executive who oversees all business operations and in the role of representative director, that person is best suited to evaluate the businesses managed by each director.

Risk Management

To ensure business continuity and stable growth in the future, KOSÉ has established the Risk Management Promotion Committee as a company-wide, cross-functional organization that comprehensively identifies risks and conducts qualitative analysis and evaluation. Specifically, risks are identified through questionnaires completed by the responsible personnel at affiliated companies and departments. These risks are then prioritized based on two evaluation criteria: the potential impact (significance and scale) on the Company’s performance, including its management results, if they were to materialize; and the likelihood of their materialization. Necessary actions are taken to address risks that could have a substantial impact.

Responding to Risks

| Risk Category | Main Risks | Main Measures |

|---|---|---|

| Strategy Risk | Price competition Damage to brand value Decrease in market share |

The Company conducts product development, marketing and sales taking into account changes in market needs and customer preferences, and works to maintain and improve its competitive advantage by adding functional and emotional value to achieve differentiation. |

| Entry of new competitors Decrease in market share due to entrants from other industries and expansion into new channels by competitors |

In addition to constantly keeping track of information from its business partners and sales and marketing sites, the Company works to remain abreast of market information in a timely manner through regular consumer surveys. It also strategically pursues unique value through active cooperation with companies in other industries and linkages with external resources and technologies. | |

| Research and development delays Decrease in brand competitiveness Decline in innovation |

The Company conducts basic and applied research using data science at the Advanced Technology Laboratory, and has also opened a branch in Lyon, France to conduct leading-edge dermatological research. The Company is also actively engaged in open innovation using external resources. | |

| Changes in consumer preferences Decrease in brand value due to deviation from consumer needs |

In addition to regularly conducting market surveys to properly obtain consumer information and conducting consumer surveys in Japan, the Company is also stepping up its surveys in countries outside Japan where it does business. It is also actively deploying digital technologies in pursuit of new customer experiences. | |

| Delays in responding to climate change Decline in business profitability due to inability to accommodate a low-carbon society |

The Company is proactively engaged in various efforts to mitigate climate change, including reducing greenhouse gases. It also strives to respond to international trends, such as disclosing information about risks and opportunities posed to business by climate change, in line with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). https://corp.kose.co.jp/en/sustainability/environment/tcfd/ |

|

| Delays in addressing human rights issues and employment discrimination Decline in business profitability and reputation due to inability to address human rights risk |

In accordance with international standards such as the UN Guiding Principles on Business and Human Rights, we have formulated the KOSÉ Group Human Rights Policy. Under the supervision of the Board of Directors, we conduct an annual assessment of human rights risks at each stage of our supply chain, within the Group, and among consumers and society. After taking appropriate actions, we proactively disclose the results. Furthermore, from a perspective of compliance, we conduct education activities to raise awareness of all forms of harassment and individual human rights issues. We have also established internal and external consulting channels. https://corp.kose.co.jp/en/sustainability/rights/hrdd/ |

|

| Business / Financial Risk | Increase in raw material prices Decline in profitability due to increased raw material prices |

The Company conducts procurement globally to minimize market risk. It also strives to procure necessary raw materials and outsourced products at reasonable prices in a timely manner while maintaining good relationships with suppliers. The Company has also established the Cost and Inventory Reduction Promotion Committee, which is working to maintain reasonable costs and secure inventories. |

| Discontinuation of raw material supply Obstacles to stable product supply Impact on sales and profit margins Decline in the Company’s creditworthiness |

||

| Political / Economic Risk | Changes in legal regulations and response Demand fluctuation risk Impact on product exports |

The Company collects information on a daily basis regarding legal regulations related to its business. In product development, the Company reviews raw material standards in light of changes in legal regulations and responds by effectively utilizing domestic and overseas information networks to secure alternative raw materials. https://corp.kose.co.jp/en/sustainability/scm/ |

| Abrupt changes in the political situation in countries and regions where the Company does business Impact on sales due to fluctuations in demand Employee safety risk |

The Company takes necessary measures by enhancing cooperation with overseas affiliates and business partners to collect information on economic, political, and social conditions in each country and region in a timely fashion. | |

| Accident / Disaster Risk | Natural disasters (earthquakes, volcanic eruptions, tsunamis, etc.) Delays or interruption of business activities due to suspension of production and logistics functions |

In the event of a disaster or the spread of an infectious disease, the Company will immediately establish an emergency headquarters to discuss and implement countermeasures. To prepare for disasters, the Company takes various steps, such as creating crisis management rules, disaster preparedness manuals and business continuity plans (BCP). It also works to confirm workplace safety, rectify deficiencies and secure alternative means in the event of an emergency. |

| Spread of highly virulent infectious disease Delays or interruption of business activities including production, supply, and sales |

||

| Personnel / Labor Risk | Securing outstanding talent Decline in corporate competitiveness |

The Company works to create an environment in which diverse human resources can play an active role. In its recruitment activities, the Company secures expert human resources through hiring by job type and outstanding talent through revision of the Beauty Consultant compensation system. |

| Legal Violation / Indemnification Risk | Problems related to product accidents Reputation loss among customers and decline in corporate brand value due to serious product accidents |

The Company manufactures products with the highest priority on delivering safe and reliable products to customers. It has articulated its stance on the KOSÉ Group’s products through its Quality Policy comprising a quality policy message and five declarations for daily activities. |

| Leaks of confidential or personal information Reputation loss and compensation for damage due to information leaks |

In addition to raising awareness of compliance through the Compliance Promotion Committee, the Company has established a Personal Information Management Committee based on laws and guidelines of the Ministry of Economy, Trade and Industry, and is working to build a comprehensive management system by strengthening information security. Furthermore, the Company holds regular training, shares information on risks and conducts thorough prevention measures. |

Business Continuity Management

Business continuity plans (BCP) have been established to minimize the impact of crises that could significantly affect the operations of the KOSÉ Group, and to resume and continue operations within an acceptable timeframe and at an appropriate level.

For business continuity management, the BCP of each group company and business unit, which is reviewed annually, is maintained through activities such as education*, training, emergency response, and other related initiatives.

All KOSÉ Group companies periodically conduct assessments to ensure that business continuity activities are suitable based on current social trends, organizational changes, business strategies, results of education programs and drills, and other considerations.

*An annual education program for management personnel to reinforce their awareness of the importance of BCP.

Business Continuity Plan

-

Basic Policy for BCP

The KOSÉ Group established the following basic policy when the BCP was initiated.

- a) The highest priority is ensuring the safety of people and assisting people who have been injured.

- b) Activities should minimize the impact of damages, quickly reduce disruptions caused by a crisis, and protect the assets of affected companies.

- c) Quickly receive, analyze and share accurate information and supply stakeholders with explanations and other information in a timely manner.

- d) Fulfill corporate responsibility as a member of society by taking actions for business continuity and the rapid recovery of communities and other business activities.

To achieve this, implement the BCP for designated crises and take all actions possible for the stable continuation of priority businesses and key business processes.

-

Current BCP Activities

A designated crisis for the KOSÉ Group BCP is an event that can damage the assets of the group or significantly interrupt or disrupt business operations (the all-hazards approach).

Each KOSÉ Group company determines designated events covered by their BCP based on the business and regional characteristics of the company. The impact of an interruption of business operations is assessed by evaluating its effects on the company, customers, suppliers, the community and others. This process is used to identify priority businesses and key business processes. For the resumption of these priority businesses and processes, each company establishes a target timeframe needed to resume operations and responds to crises with the aim of completing all necessary activities to restore operations by this established target. -

Crisis Response

When a crisis covered by the BCP occurs, all KOSÉ Group companies have a system in place to establish an emergency response headquarters at a level that reflects the severity of the crisis.

Basic Policy on Internal Control Systems

The Company has the following internal control structure to ensure that business operations are conducted properly. The Company strives to enhance its internal control structure covering all Group executives and employees and ensure its effectiveness.

-

System for ensuring that Directors and employees perform their duties in compliance with laws and regulations and the Articles of Incorporation

Meetings of the Board of Directors are held on a regular basis and additionally as needed in accordance with laws and regulations, the Articles of Incorporation, the Board of Directors Regulations, Regulations for Making Decisions and other guidelines. The Directors supervise each other regarding the performance of their duties. The Directors perform their respective duties in accordance with resolutions approved by the Board of Directors and internal regulations.

Audit & Supervisory Board Members perform audits in accordance with the Audit & Supervisory Board Regulations and Audit & Supervisory Board Member Audit Standards to confirm that Directors are performing their duties properly.

The Audit Office performs internal audits of all business operations based on the Internal Audit Regulations. Audits are performed on a regular basis to verify compliance with laws and regulations, the Articles of Incorporation and internal regulations and the suitability of procedures and other activities for conducting business operations. Results of internal audits are reported to the President and the Audit & Supervisory Board Members.

At the Company, compliance encompasses laws and regulations as well as always behaving in a manner that is consistent with social ethics based on the “Mind to follow the right path.”

The compliance structure and compliance activities are based on Risk Management and Compliance Regulations. The Risk Management and Compliance Committee submits a report about these activities on a regular basis to the Board of Directors.

The Compliance Promotion Committee holds seminars and other training programs for Directors and employees.

The Company has internal and external channels for reporting problems. This structure provides a framework for responding to reports from Directors and employees and performing consultations. -

System for the storage and management of information about the performance of Directors’ duties

Minutes of shareholders meetings and Board of Directors meetings, and important documents and information involving decisions made about business operations are stored and managed properly as stipulated in laws and regulations and internal regulations. Directors and Audit & Supervisory Board Members can see these materials at any time.

The Company has a department that is responsible for the timely disclosure of important information and other disclosure activities. In addition, Directors collect information that should be disclosed in a rapid and comprehensive manner and then, in accordance with laws, regulations and other guidelines, this information is disclosed in an appropriate and timely manner. -

Regulations and systems for the risk management of losses for the Company

In order to respond to sources of risk, including a broad range of risk factors that pose a threat to the sustainability of the Company’s business operations, particularly problems involving compliance, quality, information security, markets, natural disasters, and other potential risks, the Company has established Risk Management and Compliance Regulations for properly recognizing and managing the risks. Based on these regulations, the Company designates individuals who are responsible for the oversight of individual risk factors and maintains a risk management system.

The Risk Management and Compliance Committee supervises risk management. Discussions and activities of this committee are reported to the Board of Directors on a regular basis. The Risk Management Promotion Committee establishes risk management policies, inspects responses to risk factors and performs follow-up activities, discusses responses to problems that have occurred, and performs other activities for making further improvements to the risk management system.

The Company has established Crisis Management Regulations and has a framework for rapid and appropriate responses in order to minimize the resulting damage in cases where a significant risk occurs. -

System for ensuring that Directors perform their duties efficiently

The scope of duties, authority and responsibilities of Directors are clearly defined and the Independent External Directors/Audit & Supervisory Board Members provide supervision and oversight. This results in the proper and efficient management of the Group by the Directors.

The Board of Directors Regulations designate important items that should be submitted for decisions or as reports to the Directors for the purpose of operating the Board of Directors efficiently. In addition, the Company has a Management Committee for the purpose of making decisions about business operations efficiently.

The Company uses the executive officer system in order to make decisions about business operations quickly. -

System for ensuring the suitability of business operations of the corporate group consisting of the Company and its subsidiaries

The Company assigns personnel responsible for the overall management of affiliated companies. Also, as a rule, the Company sends Directors and Audit & Supervisory Board Members to affiliated companies in order to strengthen the Group’s governance and monitor the management of these companies.

The personnel responsible for the overall management of affiliated companies requires all subsidiaries to submit reports about their operations, financial condition and other important items in accordance with the Regulations on Management of Affiliated Companies.

In addition, internal audits by the Audit Office include all of the activities of affiliated companies. In accordance with Internal Audit Rules, the Audit Office performs periodic internal audits regarding compliance with laws and regulations, the Articles of Incorporation and internal regulations and the suitability of procedures and other activities for conducting business operations. -

System for ensuring the reliability of financial information

To ensure the reliability of financial information, the Company establishes and operates internal controls related to financial reporting as prescribed in the Financial Instruments and Exchange Act and other legislation, and evaluates and reports on the effectiveness of these controls on an ongoing basis. Furthermore, the Company quickly takes actions when revisions or improvements are needed for internal controls.

-

System for reporting from Directors or employees to Audit & Supervisory Board Members and for other reporting to Audit & Supervisory Board Members

Directors and executive officers submit periodic reports about the performance of their duties to Audit & Supervisory Board Members. In addition, executives and employees immediately report to Audit & Supervisory Board Members any serious violation of a law or regulation at the Company or a group company or any other serious matter involving compliance. The Company has a system that allows employees to submit directly to Audit & Supervisory Board Members any information about matters that may cause a significant loss to the Company.

-

System for ensuring no negative consequences for individuals who submit reports to Audit & Supervisory Board Members

The Company has regulations concerning compliance and internal reports. In accordance with this manual, when a Director or employee of the Group makes a compliance violation report, there will be no negative consequences for that individual because of the submission of the report. In addition, information about the individual who submits the report and the contents of the report are handled in accordance with strict rules.

-

Other systems for ensuring that audits by the Audit & Supervisory Board Members are performed effectively

The Audit Office and Audit & Supervisory Board Members exchange information periodically and work together in other ways concerning formulation of an internal auditing plan for each fiscal year, internal audit results and other matters.

The Audit Office and Audit & Supervisory Board Members monitor and verify the status of implementation and operation of these systems.